What is Paystream?

This architecture allows users to:

- Earn higher yields with optimized P2P matching

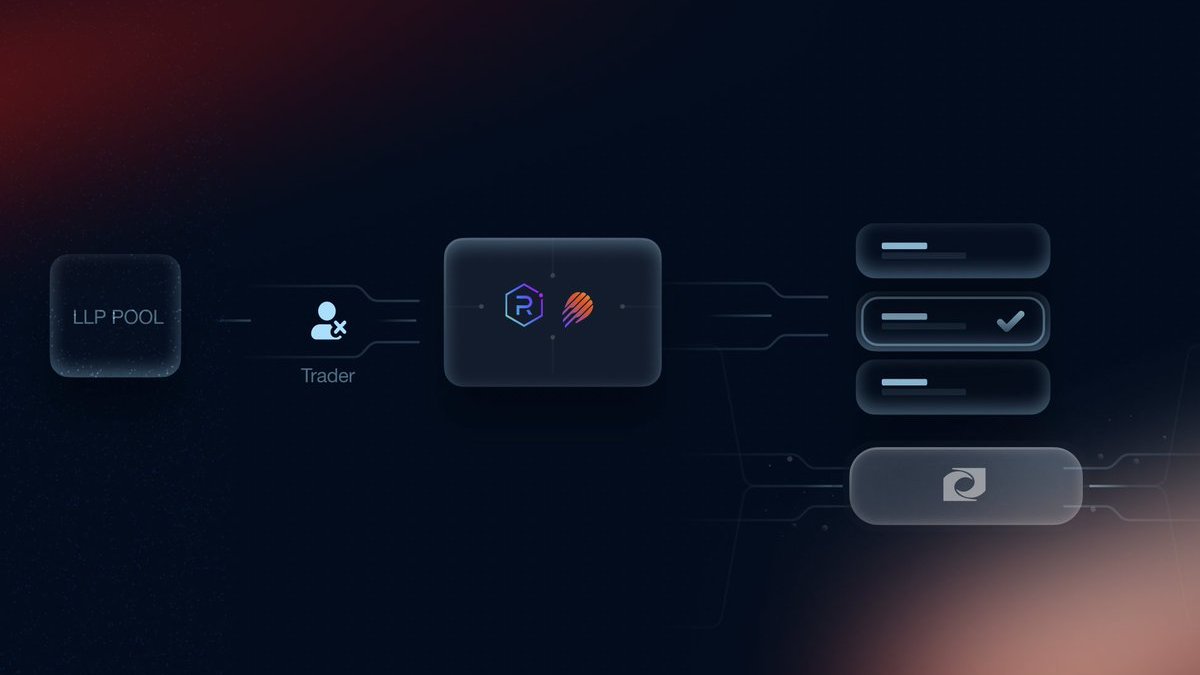

- Farm more fees across protocols like @MeteoraAG and @RaydiumProtocol

This article provides a high-level overview of how Paystream works from a user’s perspective. For a more detailed description, please refer to the official Paystream documentation.

At Paystream, our mission is simple: Solve inefficiency across all liquidity markets.

https://x.com/MaushishYadav/status/1974216576053194862

For now, Paystream has mainly two major components:-

- LLP(Leveraged Liquidity Provisioning)

- P2P engine module

How does LLP work?

Traders can borrow from the LLP pool to boost their capital allocation and open leveraged LP positions on protocols like Meteora and Raydium. This lets them farm significantly higher fees than with just their own funds.

Ex:- Trader Bob starts with $10,000 in capital ($5,000 in BONK + $5,000 in SOL).

Using LLP, Bob can leverage up to a 10× position, giving him exposure of up to $100,000 in liquidity.

This amplified position enables Bob to earn fees on a much larger base, far beyond what his original $10,000 could generate.

Note:- LLP leverage level will depend on the Pool's available liquidity

Tho this feature only works if the user wants to farm LP fees, not for other yield operations, and that's where the P2P engine comes into play.

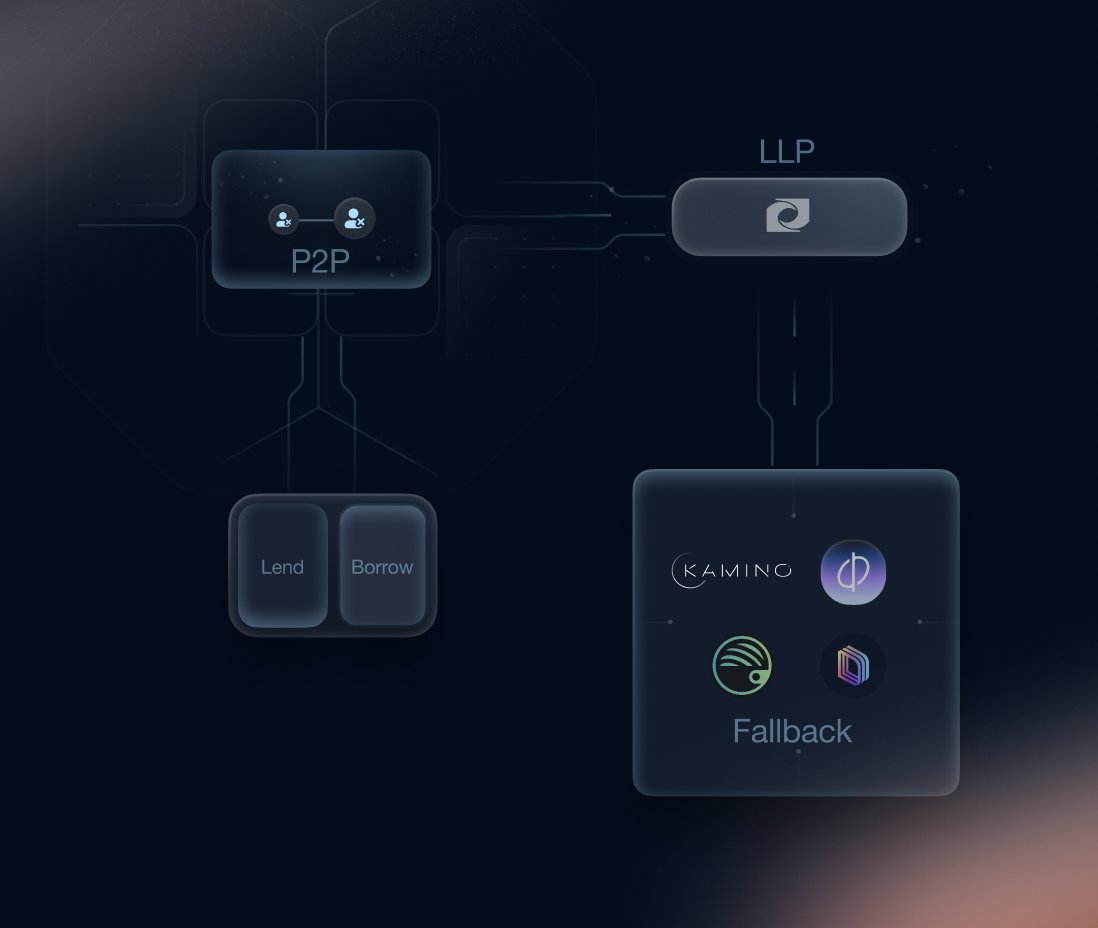

What is the P2P engine?

The P2P engine is Paystream’s matching layer that connects lenders and borrowers at an optimized mid-rate, eliminating the inefficiencies of pool-based models.

- Lenders earn more than in traditional pools.

- Borrowers pay less than they would in external protocols.

- Idle capital never stays idle as the unmatched liquidity is redirected into the LLP pool, which can then be used by LP traders to open bigger positions, and if there are no traders, it goes into fallback protocols like @kamino, @jup_lend, @0dotxyz, @DriftProtocol.

Ex:- Alice deposits 10,000 USDC into Paystream. Bob wants to borrow the same amount.

On Kamino, Alice would earn 4% and Bob would pay 7%.

With Paystream’s P2P engine, they’re matched directly at ~5.5%.

Alice earns more, Bob pays less, and if no borrower is available, her funds move into the LLP pool or fallback protocols, where both parties will earn the market rates.

In the end, for an end user, using Paystream is a win-win situation, as the lowest yield rates you would get are the market rates, which in this case is 4%.

Thanks for reading!