Paystream: Building the Liquidity Optimizer of Solana

Currently, Solana’s lending markets are inefficient. Protocols like Kamino and Juplend focus on utilization over user returns, creating wide APY spreads and idle capital. Paystream introduces a peer-to-peer yield engine that matches lenders and borrowers at optimal market rates while maintaining full liquidity through fallbacks. To solve P2P fragmentation, Paystream adds Leveraged Liquidity Provisioning, allowing traders to borrow and open leveraged LP positions in Raydium CLMM and Meteora DAMM v2 or DLMM pools. This unified system turns idle liquidity into productive capital, delivering yields far higher than traditional pools and creating a new standard for on-chain lending efficiency.

Paystream Labs aims to make every liquidity market more efficient by helping users earn maximum yield and trading fees, solving the long-standing problem of unoptimized liquidity. To advance this goal, Paystream is launching its token through MetaDAO, creating a community-driven foundation with incentives designed for long-term, sustainable growth.

Our target raise through this ICO is $550,000.

Token Supply & Allocation

Fixed Supply

Paystream's ICO introduces 10 million tokens into circulation at a fixed supply.

NO FCFS. NO SPECIAL TIERS.

Along with this, 2.9M tokens are reserved for Liquidity, with 2M paired with 20% of the funds raised.

Liquidity Structure and Market Depth

To ensure healthy trading activity and stable price discovery from day one, 2.9 million tokens are allocated for liquidity. Out of this, 2 million tokens will be paired with 20% of the funds raised during the ICO to create a deep and balanced liquidity pool, guaranteeing immediate market access for participants. The remaining 900,000 tokens will be deployed as single-sided liquidity on Meteora, serving as a volatility dampener and stabilizing pool performance.

Team Allocation and Incentive Design

Unlike most protocols that use simple time-based vesting, Paystream follows a performance-linked unlocking model that directly connects contributor rewards to real progress and growth.

- Team + Early backers allocation totals 11.85 million tokens, which are locked for the initial 18 months.

- After the cliff tokens unlock in five tranches of 20% each, every double from the opening FDV post ICO.

Paystream believes that fair markets build lasting trust. Every participant enters under the same conditions, with no private rounds or insider discounts. This approach keeps governance signals clear and ensures the system operates as an open, market-driven economy. The liquidity structure complements this fairness by pairing a share of the raise with tokens to create deep, stable, and active markets from day one.

This model connects the team’s success to Paystream’s long-term health. When the protocol grows, the team grows with it, creating a transparent, accountable, and sustainable foundation for everyone involved.

Total Supply at Launch

Paystream’s total token supply at launch is 24.75 million tokens, allocated as follows:

- 10 million for the ICO at a fixed price for all participants

- 2.9 million for liquidity, including 2 million paired with 20% of funds raised and 900,000 as single-sided liquidity on Meteora

- 11.85 million for the team and early contributors, locked for 18 months and unlocked based on performance milestones

Alignment for Long-Term Growth

This allocation structure is built with sustainability and fairness at its foundation. The founding team holds less than one-fifth of the total supply, reflecting Paystream’s commitment to a community-driven model rather than insider-heavy ownership. Early supporters, contributors, and future builders are included in the distribution to ensure that success is shared among those who believed in Paystream from the start and those who will drive its next phase. All allocations to early backers are subject to structured vesting and price-based unlock schedules, reinforcing long-term accountability and alignment with the protocol’s growth and value creation.

Governance and Community Ownership

From day one, Paystream will function as a community-owned protocol governed by a decentralized framework. Once the raise concludes, all core resources, including remaining USDC, liquidity reserves, and the authority to mint tokens, will be transferred to a newly formed DAO. This ensures that control and decision-making power rest with the contributors rather than a central team.

Token holders will be able to submit proposals, vote on initiatives, and collectively decide how Paystream evolves, including funding new features, partnerships, and ecosystem incentives. The DAO will also use decision markets and futarchy-based governance to enable transparent and efficient resource allocation.

This structure establishes genuine decentralization from the start, embedding fairness, transparency, and community-led ownership at the heart of Paystream’s growth.

Use of Funds

Paystream is committed to financial discipline and transparent capital allocation. The protocol will follow a lean, efficiency-focused strategy that prioritizes sustainability and long-term growth. Operational expenses are budgeted to maintain a balanced monthly burn while ensuring consistent progress across development, audits, and expansion.

A major share of the raised funds will be directed toward security audits with top-tier firms to guarantee that Paystream’s lending and liquidity systems remain resilient and safe for users. Legal and regulatory compliance will also be a key focus, ensuring responsible operation across jurisdictions and clear governance for contributors.

Additional resources will support infrastructure, developer growth, and ecosystem incentives, enabling Paystream to scale securely, attract leading talent, and strengthen its foundation for global adoption.

Path to Revenue

1. Protocol Fees from Lending and Leveraged Liquidity

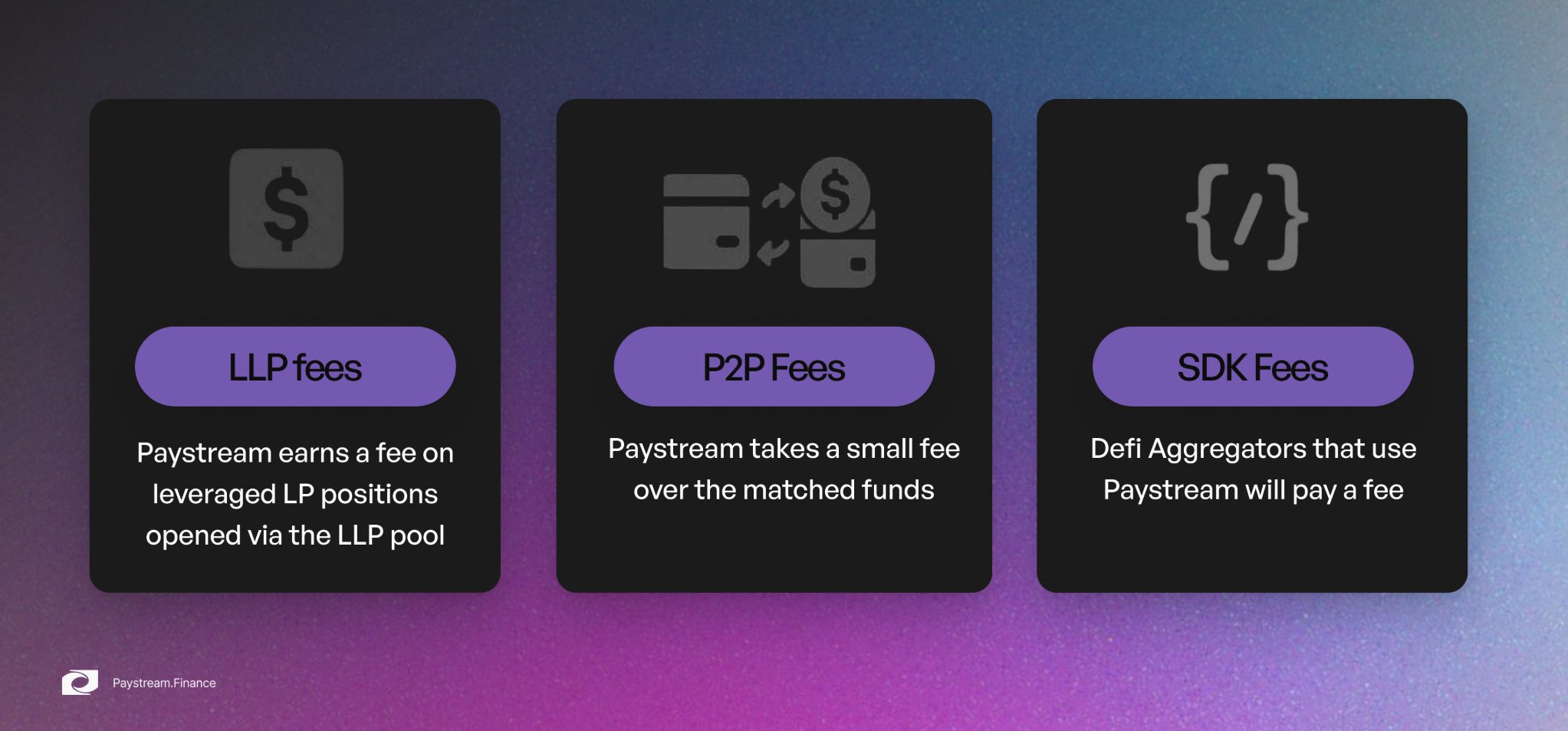

Paystream earns revenue directly from protocol activity through small fees on matched P2P transactions, performance and liquidation fees from leveraged LP positions, and nominal withdrawal fees. Deposits remain free, encouraging liquidity inflow and user participation while maintaining sustainable yield generation for the protocol.

1. Protocol Fees from Lending and Leveraged Liquidity

Paystream earns revenue directly from protocol activity through small fees on matched P2P transactions, performance and liquidation fees from leveraged LP positions, and nominal withdrawal fees. Deposits remain free, encouraging liquidity inflow and user participation while maintaining sustainable yield generation for the protocol.

2. SDK and Aggregator Integrations Paystream’s SDK powers external DeFi platforms, aggregators, and wallets, which pay usage-based fees tied to transaction volume. As integrations grow, this creates a compounding network effect where developer adoption amplifies protocol activity and revenue simultaneously.

This dual model, combining protocol-level fees with SDK monetization, ensures Paystream captures value from both direct user activity and ecosystem integrations, aligning growth, sustainability, and scalability across all layers of the protocol.

Post-ICO Build Plan

Building a real product takes time, iteration, and adaptability. While timelines may adjust as we solve technical challenges, here is what you can expect after the ICO. 1. LLP Terminal Launch Paystream’s first major release will introduce the Leveraged Liquidity Provisioning Terminal, enabling traders to farm higher fees and lenders to earn greater yield on SOL. The first one hundred users will gain access through an Alpha to Beta rollout. If you have not joined the waitlist yet, now is the time.

2. Gradual User Onboarding After the initial phase, access will expand in carefully managed batches to ensure smooth scaling and rapid iteration based on community feedback. This approach allows us to refine performance and strengthen system safety before wider access.

3. P2P Engine Integration Users will gain access to Paystream’s P2P Engine, unlocking optimized yield benefits. Before the P2P engine, lenders will initially provide SOL liquidity, and later the engine will expand to multiple markets.

4. Security Audits and Public Launch Preparation Once the P2P Engine enters private beta, Paystream will undergo rigorous audits to ensure protocol security and readiness for Public Launch.

The post-ICO phase is centered on execution, community feedback, and consistent delivery of real value to users.

See you on 23 October on Metadao!

Gpays!